Why Large & Midcap Funds Are Becoming a Preferred Choice During Market Volatility

Dec 24, 2025

VMPL

New Delhi [India], December 24: Market volatility has become a common feature of today's investing landscape. Sudden corrections, global uncertainties and frequent shifts in sector performance often leave investors unsure about which equity category to choose. In this environment Large & Midcap Funds are emerging as a preferred option for many investors particularly those seeking stability without missing out on growth opportunities. By combining the strength of large cap companies with the growth potential of mid cap businesses these funds offer a balanced and resilient investment approach

Key Takeaways

* Large & Midcap Funds offer a balanced approach by combining the stability of large cap companies with the high growth potential of mid cap businesses

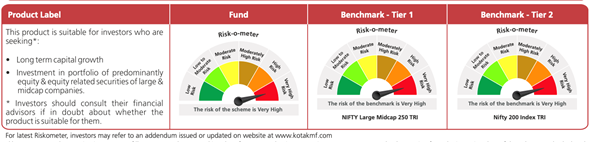

* SEBI mandates a disciplined structure requiring these funds to invest 35-65% each in large caps and mid caps ensuring diversification across market segments

* They help manage market volatility through exposure to large cap stability while participating in mid cap led market recoveries

* Suitable for long-term investors especially those who want consistency, growth and reduced exposure to extreme volatility

What Are Large & Midcap Funds?

A Large & Midcap Fund is an equity mutual fund that invests in both large cap companies for stability and mid cap companies for higher growth potential. SEBI mandates that these funds must invest at least 35-65% each in large caps and mid caps ensuring a disciplined and diversified structure.

This combination allows investors to benefit from

* the steady performance and lower volatility of large enterprises

* the faster earnings growth and upside potential of mid sized companies

As a result these funds strike a unique balance reducing extreme risk while still tapping into meaningful market opportunities

Why Large & Midcap Funds Shine During Market Volatility

Large & Midcap Funds are gaining popularity among investors especially those seeking stability without compromising on long term growth. By investing in both established large cap companies and high potential mid cap businesses these funds offer a balanced approach making them particularly appealing during uncertain market phases.

1) Stability from Large Cap Allocation

Large cap companies are typically well established industry leaders with strong fundamentals, consistent cash flows and resilient business models. Their presence in a Large & Midcap Fund helps absorb market shocks and reduces downside risk during turbulent periods

2) Growth Boost from Mid Cap Stocks

While mid caps may experience sharper short term fluctuations they also tend to rebound faster after market corrections. Their long term growth potential contributes meaningfully to the fund's performance especially during market recoveries

3) Balanced Risk Return Profile

Investing solely in mid caps can be aggressive whereas a pure large cap strategy may deliver relatively modest returns. Large & Midcap Funds offer a middle ground providing growth opportunities while maintaining a more controlled risk profile

4) Diversification Across Market Segments

Not all segments of the market move in the same direction during volatility. Large caps may stay relatively stable while mid caps could experience more movement. Combining both segments in a single fund reduces concentration risk and provides smoother performance across market cycles

5) Fund Manager Flexibility Within a Defined Mandate

Even though SEBI specifies the minimum allocation to each segment, fund managers have the flexibility to choose stocks based on sector trends, earnings outlook, valuation metrics and market conditions. This flexibility becomes especially valuable when markets behave unpredictably

6) Ideal for Long Term Investors Seeking Consistency

For investors willing to stay invested for five years or more, Large & Midcap Funds offer a blend of stability and long term wealth building potential. Despite short term fluctuations the combination of large cap resilience and mid cap growth can work effectively through compounding

Who Should Consider Large & Midcap Funds in Volatile Markets?

This category is suitable for

* Investors with a high risk appetite

* Those looking for stability plus growth

* Long term investors (5+ years)

* Individuals seeking a core equity fund in their portfolio

* Investors who do not want to choose between large cap and mid cap allocations themselves

Benefits of Investing in Large & Midcap Funds

* Growth + stability in one scheme

* Diversification across different market-cap segments

* Reduced volatility compared to pure mid/small cap funds

* Better long term return potential compared to pure large cap funds

* Strong recovery potential after market downturns

* Professional management for stock selection and portfolio balancing

Conclusion

In times of market volatility investors naturally seek solutions that offer both resilience and meaningful growth potential. Kotak Large & Midcap Funds deliver exactly that. By blending the strength of large caps and the agility of mid caps these funds create a strategic, stable and growth oriented approach to equity investing. For individuals looking to navigate uncertain markets while staying focused on long term wealth creation, Large & Midcap Funds are emerging as one of the strongest and most reliable choices

FAQs

1) Are Large & Midcap Funds suitable during market volatility?

Yes. These funds offer a blend of stability from large caps and growth from mid caps making them well suited for volatile markets

2) What is the SEBI rule for Large & Midcap Funds?

SEBI requires these funds to invest 35% to 65% each in large cap and mid cap companies ensuring disciplined allocation and diversified exposure

3) Who should invest in Large & Midcap Funds?

They are ideal for investors with a high risk appetite, long-term goals (5+ years) and those looking for a single fund that provides both growth and stability

5) What is the recommended investment horizon?

A minimum of five years or more is suggested to benefit from compounding, recovery cycles and the growth potential of mid cap companies

6) Are SIPs effective for investing in Large & Midcap Funds?

Absolutely. SIPs help average out market volatility, reduce timing risk and allow investors to build wealth steadily over time

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)